Disc Golf Brand Popularity – 2017 State of Disc Golf Results

Brand Awareness

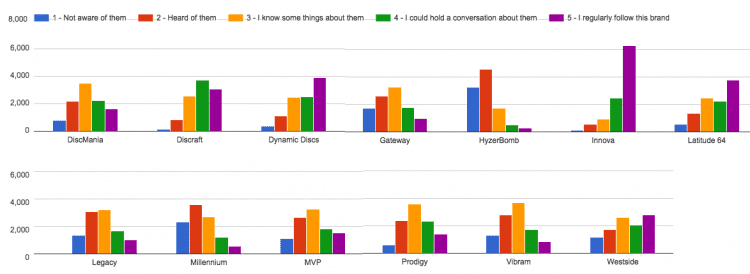

When it comes to disc golf brand awareness, Innova remains king. While Dynamic Discs and Latitude 64 have taken great strides to increase their popularity and reputation, far more disc golfers are aware of Innova than any other brand.

This graph shows a break down of the overall awareness of brands included in the survey by combining all categories other than the “not aware of”.

Favorite Brands

At Infinite Discs we are able to get a good feeling for which brands are favorable by what sells. It’s also interesting to see which brands people find favorable based on a survey. The results are pretty similar and not surprisingly, Innova is the most favorite brand according to the 2017 State of Disc Golf Survey. The graph between “Favorite Brands” and “Regularly Follow are pretty similar.

I Bag ‘Em

While 75% of those surveyed include Innova among their favorite brands, the number of players that throw at least one Innova Disc is even higher! 83% of surveyed disc golfers carry at least one Innova Disc in their bag. This is 24% higher than second place Discraft where 59% of surveyed disc golfers bag their discs.

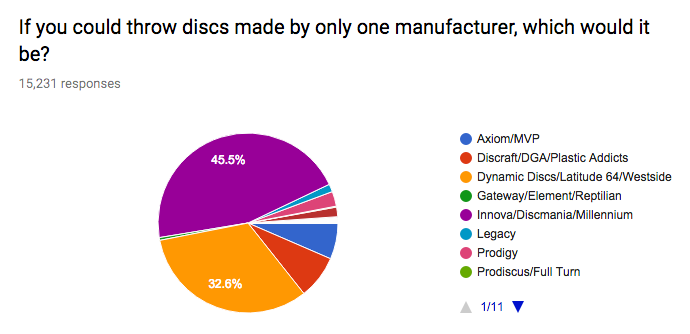

Limited to an Exclusive Manufacturer

Likely a result of Innova’s dominance in terms of recognition and the number of people that own their discs, when the question “If you could throw discs made by only one manufacturer?” was asked, nearly half (45.5%) of survey respondents said they would choose Innova. One third (32.6%) chose the Swedish manufactured trilogy discs. Only a very small percentage of disc golfers said they would choose any other manufacturer if they had to exclusively throw only that brands discs. Discraft came in third at 7.8% followed by MVP at 6.5% and Prodigy in a distant fifth at 2.7%.

Of those surveyed, a whopping 91.8% were male, leaving only 8.2% as female. Does that truly reflect the balance of men vs. women in the game of disc golf? Though it might actually be a fairly accurate representation, we can surmise that simply less women are passionate enough about the game to take a survey (as mentioned above). But it would probably be an accurate statement to say that among passionate disc golfers, only 1 out of every 10 is a woman.

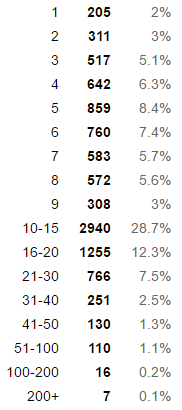

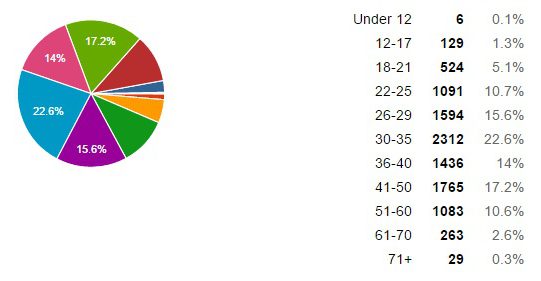

Of those surveyed, a whopping 91.8% were male, leaving only 8.2% as female. Does that truly reflect the balance of men vs. women in the game of disc golf? Though it might actually be a fairly accurate representation, we can surmise that simply less women are passionate enough about the game to take a survey (as mentioned above). But it would probably be an accurate statement to say that among passionate disc golfers, only 1 out of every 10 is a woman. Looking at the age of those surveyed, we were happy to see a very wide spread. Though the age group that participated the most was the 30-35 demographic with 22.6%, other age groups ranging from 18 all the way through 60 were quite well represented. For those of us inside the disc golf industry, that is a very healthy statistic– to see that passionate players exist within all age groups. There is ground to be gained in the 17-and-lower age group, but that again could be an example of a group of people who are not interested in taking online surveys.

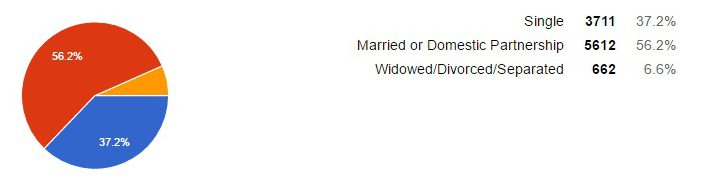

Looking at the age of those surveyed, we were happy to see a very wide spread. Though the age group that participated the most was the 30-35 demographic with 22.6%, other age groups ranging from 18 all the way through 60 were quite well represented. For those of us inside the disc golf industry, that is a very healthy statistic– to see that passionate players exist within all age groups. There is ground to be gained in the 17-and-lower age group, but that again could be an example of a group of people who are not interested in taking online surveys. The majority of those who took the survey are married, with just more than half, at 56.2%. Single came in at 37.2%, and the widowed / divorced / separated group came in at 6.6%. By the way, as of 2015, roughly 55% of all Americans over the age of 18 were married, so the players surveyed fall pretty much within the national average.

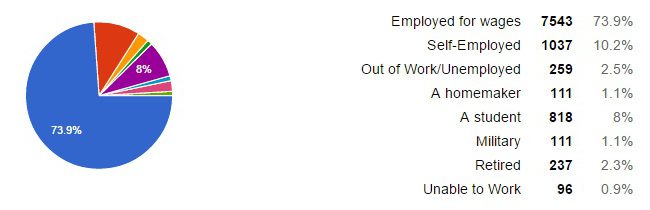

The majority of those who took the survey are married, with just more than half, at 56.2%. Single came in at 37.2%, and the widowed / divorced / separated group came in at 6.6%. By the way, as of 2015, roughly 55% of all Americans over the age of 18 were married, so the players surveyed fall pretty much within the national average. When looking at the employment status of those surveyed, the vast majority are employed for wages, with a few being self-employed. There is a sizable group of students that took the survey, but thankfully, not too many are unemployed or unable to work.

When looking at the employment status of those surveyed, the vast majority are employed for wages, with a few being self-employed. There is a sizable group of students that took the survey, but thankfully, not too many are unemployed or unable to work.