When Paul McBeth announced his change of sponsors from Innova to Discraft at the end of 2018 we knew it would have an impact on the buyer behavior of die hard disc golfers. Many scoffed at the million dollar contract and wondered how Discraft could afford to pay a professional disc golfer that much money.

After looking at our sales numbers for the first half of the year 2019, it appears that Paul McBeths brand value for disc sales may have been underestimated. When it comes to “hot brands of 2019,” among the major players, Discraft is on fire.

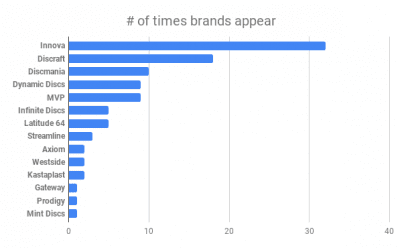

During the first six months of 2018, Discraft was our #5 brand in terms of disc sales. The Innova, Discmania, Dynamic Discs, and Latitude 64 brands all accounted for more InfiniteDiscs.com sales than did Discraft — which represented less than 7% of our online sales.

Jan – June 2019 InfiniteDiscs.com Sales By Brand

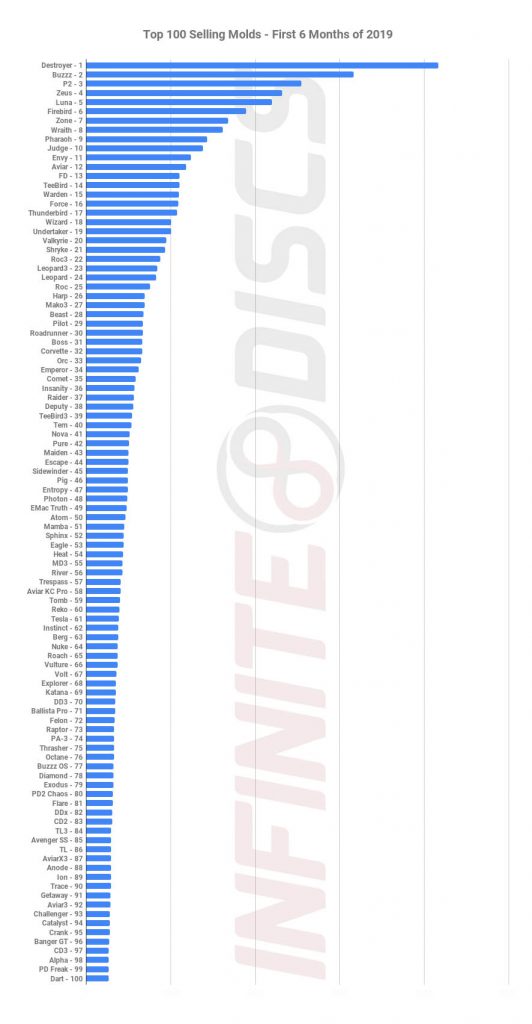

Through the first half of 2019 Discraft sales have nearly tripled! The introduction of the Paul McBeth Kong/Zeus was our hottest disc release ever. Sales of the Anax and Luna were almost just as hot. While Innova is still #1, Discraft has sold more discs than the #3 and #4 brands combined. The sales difference gap between Innova and Discraft was less than 13% during the first half of 2019 compared with a 31.5% difference during the same time period one year ago.

Not all of the credit can be given to Paul McBeth. Discraft has made some major changes to prepare themselves for a massive production increase that would bring their brand back to the top. Discraft Swirly ESP plastic is arguably the best looking plastic on the market. Discraft has done a brilliant job re-marketing themselves as a leader in disc golf.

With such a rapid increase in Discraft sales, the question arises, is it at the expense of other brands?

Overall, our total disc sales at Infinite Discs are up slightly for the first half of the year, but Discraft is taking market share from others and we have seen a year over year decline in sales for some brands.

Brands That Saw Sales Declines

Among the larger brands we sell, Innova and Discmania (brands Paul McBeth used to promote) have seen a slight decline in sales. During the off season, Discmania made some significant changes by also manufacturing with Latitude 64 and Yikun. With these changes I was very surprised to see that our Discmania sales declined. Had they sufficient stock of DD3’s to meet our buyers demand, I’m pretty sure Discmania would not have appeared on this list.

The biggest “hit” taken on brand preference in 2019 among our customers appears to be decreased demand for Latitude 64 and Westside Discs. Our online sales for Latitude 64 were down 17% while the Westside brand was down almost 25%. One likely reason for a decrease in sales of these brands is the loss of Ricky Wysocki as a Latitude 64 sponsored player.

During the first six months of 2018, the Westside Harp (one of the primary discs used by Ricky Wysocki) was our #11 selling disc. During the same period of 2019, Harp sales dropped to #26. The Explorer dropped from #36 to #62 and the Dagger dropped from #47 to #92.

Meanwhile the Innova Pig went from being our 175th best selling disc in 2018 to our 45th best selling disc during the first half of 2019. Despite the loss of Paul McBeth, the Ricky Wysocki signature Destroyer has helped that disc remain as our top selling disc of 2019. The addition of Ricky Wysocki to Team Innova undoubtedly lightened the blow of losing McBeth.

Other Brands That Increased in Sales Despite Discraft’s Surge

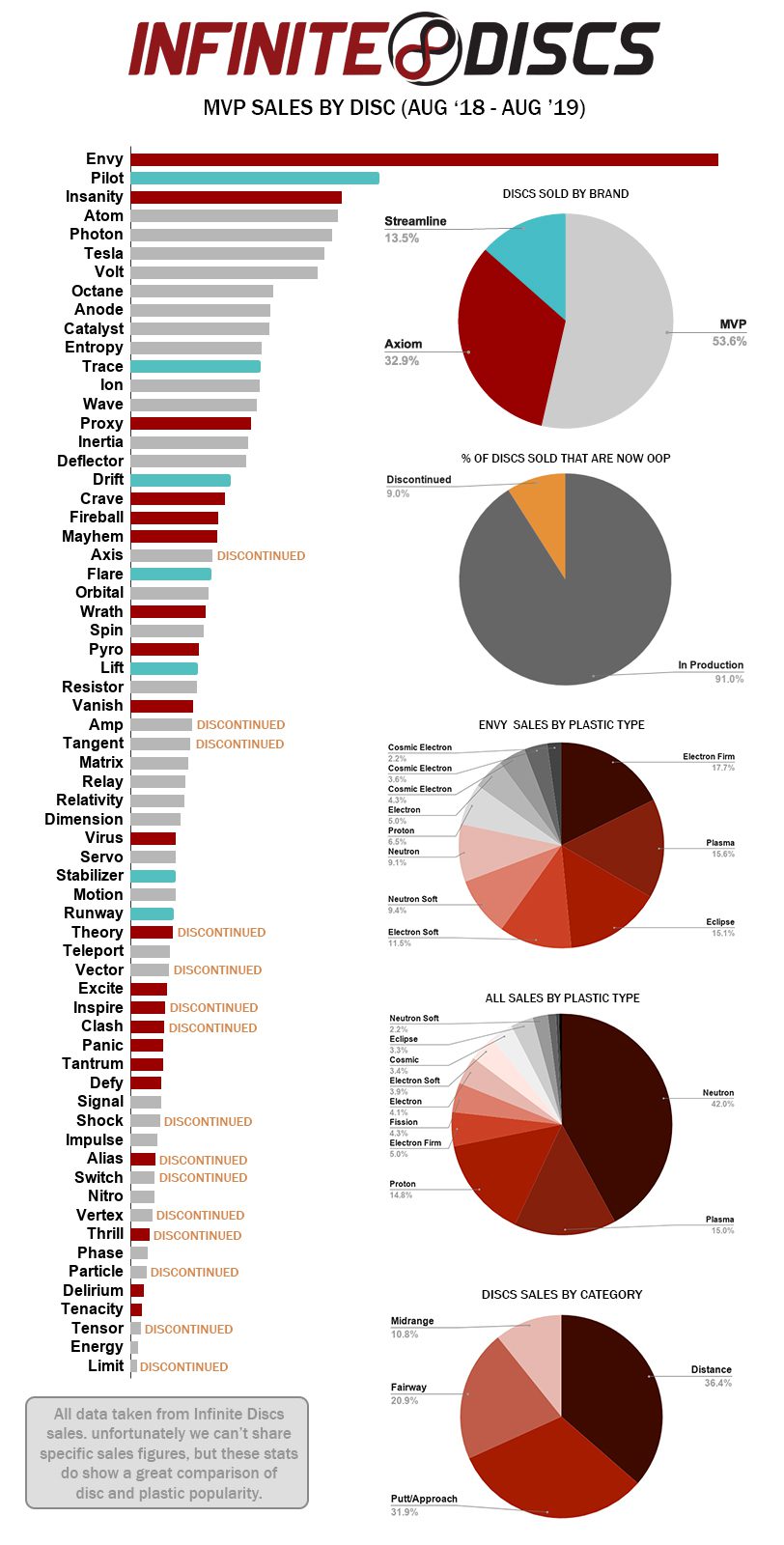

The third member of the Trilogy family, Dynamic Discs, saw a modest 3% sales increase compared with 2018. The new Raider distance driver undoubtedly helped those sales.

MVP and Axiom, with their triple foil artwork and loyal fan-base, saw growth rates of 24% and 27% respectively. Their unrelenting new release schedule and new swirly plastic blends fanned the flames.

With the addition of five new molds, sales of the Infinite Discs brand increased by 66% during the first half of 2019.

Prodigy Disc saw an impressive sales increase 43%. Some of this increase can be attributed to the success of their pros, particularly Kevin Jones, who is having a fantastic year and is becoming one of the most liked players on tour.

Gateway, which has made a big emphasis on improving their premium plastic look and feel, saw a modest increase in 2019 sales of 5%.

Most of the smaller disc brands also saw an increase in our online sales with the exceptions being Legacy, Hyzer Bomb, and Viking Discs. A primary reason for the reduction in Viking sales is our inability to order more of these discs from Finland. We have been in need of a major restock for most of the year, and we can’t sell discs that we do not have. With Hyzer Bomb, the sales figures are most likely an adjustment after an incredible run on Mortar discs.

Growth Among Smaller Disc Brands

The introduction of several new molds, as well as the new “Cosmic Neutron” plastic blend, has helped Streamline to a 91% 2019 sales increase. Through the first six months, Streamline is currently our #11 selling disc brand.

Kastaplast’s popular plastic feel and increased availability lead to an increase of more than double their 2018 sales in 2019.

Yikun saw the largest percentage of sales growth from companies not named Discraft. The increase in Yikun sales may be partially attributed to Discmania’s partnership with the Yikun brand which has some players interested in checking out the additional molds.

DGA saw a 56% increase in sales during the first half of 2019. DGA’s likely benefited from their partnership with Discraft and the fact that Paul McBeth spent some time throwing DGA branded discs.

RPM discs out of New Zealand saw a healthy 84% year over year increase while Finland’s Prodiscus brand saw a modest 27% improvement.

The release of their second disc, the Bobcat, helped Mint Discs increase sales by 65% this year.

The first half of 2019 has been a dramatic ride for the ever changing landscape of disc sales. It will be interesting to see if the Discraft popularity surge has peaked, or if the hype for Paul McBeth products will continue.

Disclaimer: The numbers used for this article are taken solely from InfiniteDiscs.com sales, and do not necessarily reflect the actual sales trends for the different brands among all retail outlets. InfiniteDiscs.com customers are primarily avid disc golfers who regularly follow professional disc golf. Casual disc golfers, that represent the majority of people who play disc golf, are less likely to be influenced by the moves of professional disc golfers.