How New Disc Golfers differ from Experienced Disc Golfers

Rise of New Disc Golfers

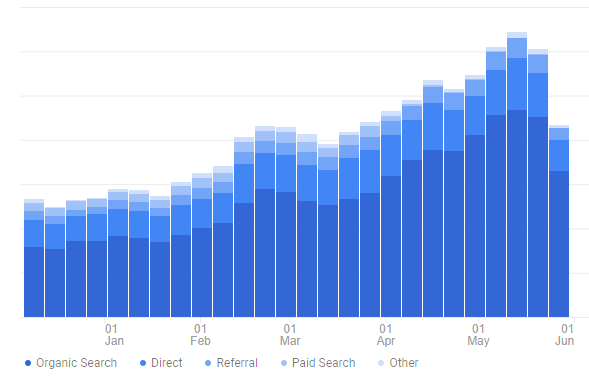

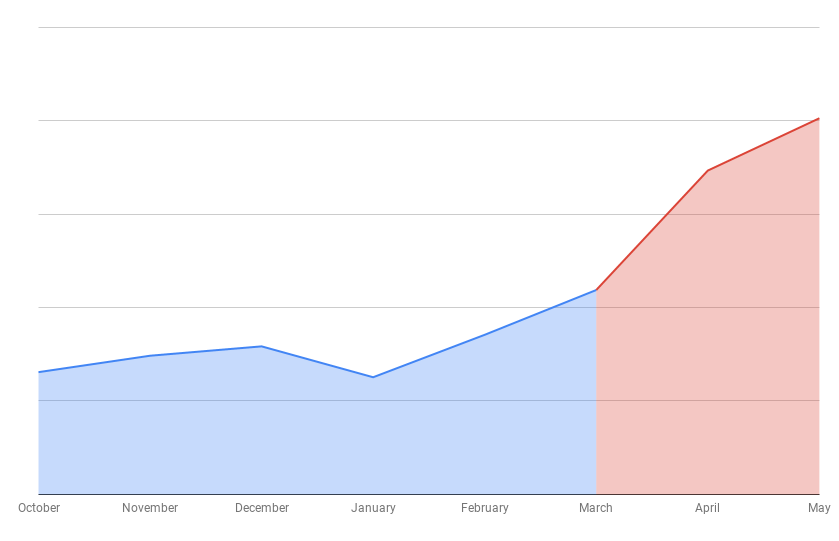

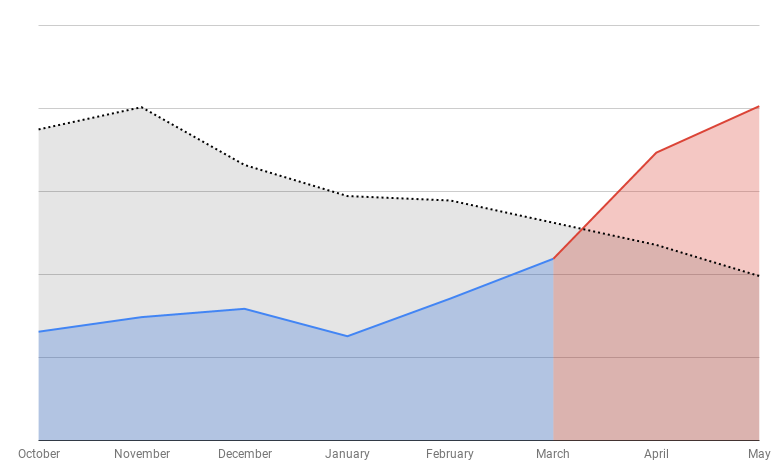

As has been pointed out in numerous blogs, podcasts, YouTube videos, and even this blog series, the pandemic has created a boon for the sport of disc golf. A perfect storm of having more time on our hands, the need to socially distance from people, in many cases a bump in income from the federal government, and a sport that is relatively inexpensive and easy to get into has led to unprecedented growth for disc golf. That growth has not been without its pains. Shutdowns, materials shortages, and the increase in demand have led to challenges in maintaining inventory.

Even with the difficulties we are experiencing, and have experienced, it is great to see so many new people embracing the sport we love. Those new players are going to be the focus of this blog. We’ll take another look at how many survey respondents indicated that they started playing last year. Then we’ll look at why they started, how many discs they’ve amassed, and we’ll take a peek inside their bag to see what they are throwing. Finally, we’ll also compare their responses to the ‘veteran’ disc golfers to see what we can learn about them and us.

New To The Sport

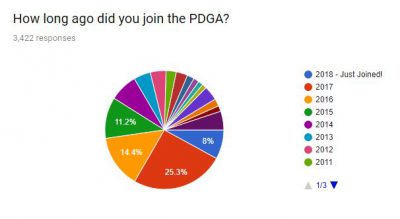

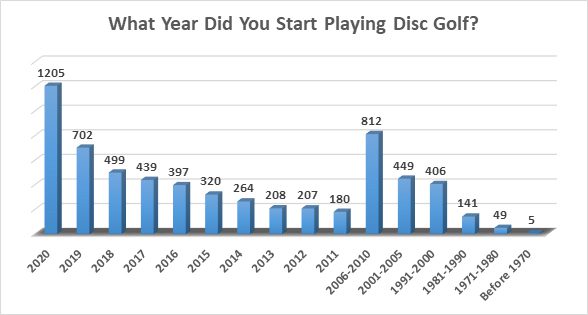

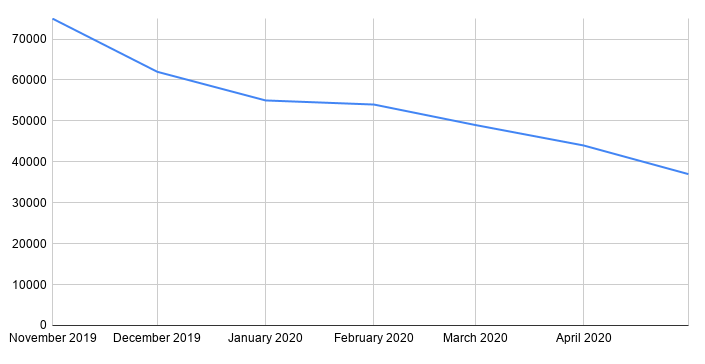

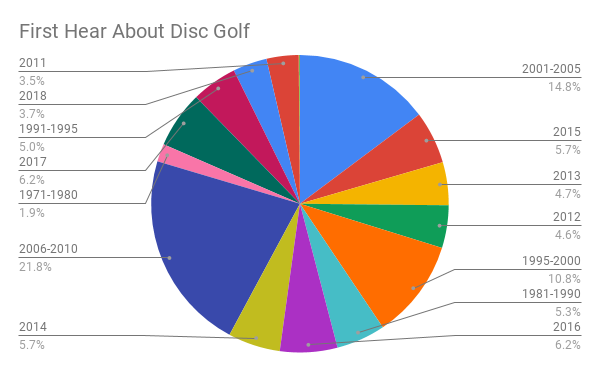

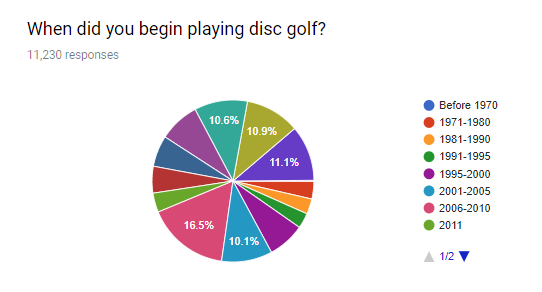

Let’s start by seeing when people indicated in the survey that they started playing. In a previous State of Disc Golf 2021 blog we learned that nearly 20% of respondents started playing last year. Here are those results:

Let’s take a look at a few previous years’ survey results to see how the pandemic might have affected the results of the same question (as if we really wonder how it was affected!) Here are the results from two previous years. The chart shows the survey year, and the percent of people who started playing disc golf the previous year:

| 2015 | 9.70% |

| 2019 | 10.20% |

| 2021 | 19.20% |

Given that extraordinary increase in the number of people who joined the PDGA last year, the 19% figure could have been a lot higher and it wouldn’t have surprised me. Still, one in five of all survey respondents starting last year isn’t too shabby.

Introduced To Disc Golf

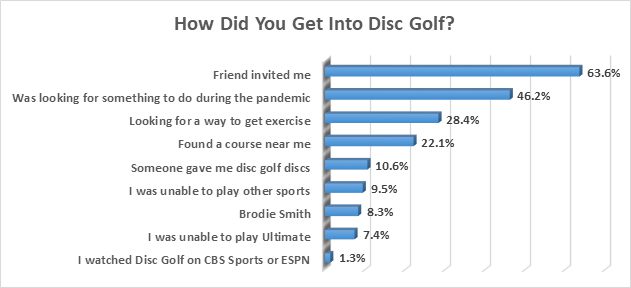

The follow-up question in the survey was for people who indicated that they started last year, and that question was, “How did you get into disc golf?” I discovered in writing this blog that the spreadsheet format excluded some of the answers in the previous blog, so I ran the data again and here are the accurate numbers for that question:

Just like last time, the number one reason people started playing disc golf was because of a friend. What better way to share the sport than inviting a friend? Close to half of all respondents who started last year were looking for something to do during the pandemic. Over 28% wanted some way to get exercise, while 22% just stumbled onto the sport. Even though the smallest number of respondents found disc golf from seeing it on a sports program, I like the idea that people are intrigued enough from watching disc golf to give it a try.

In Their Bag

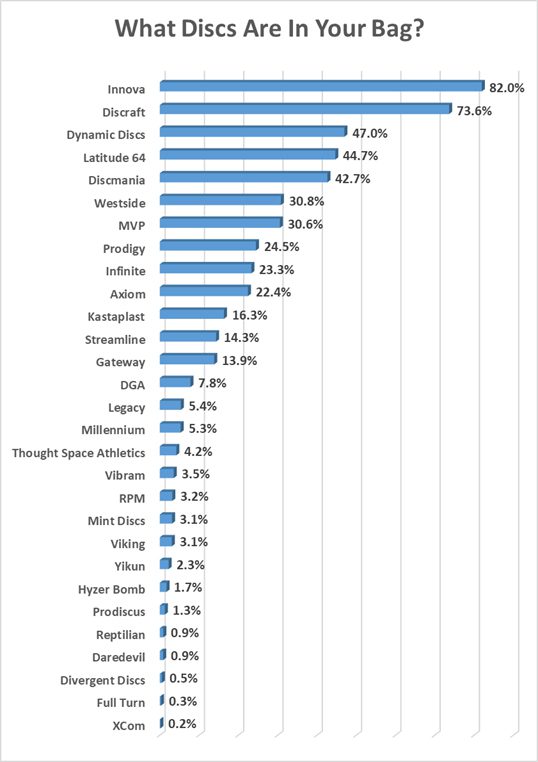

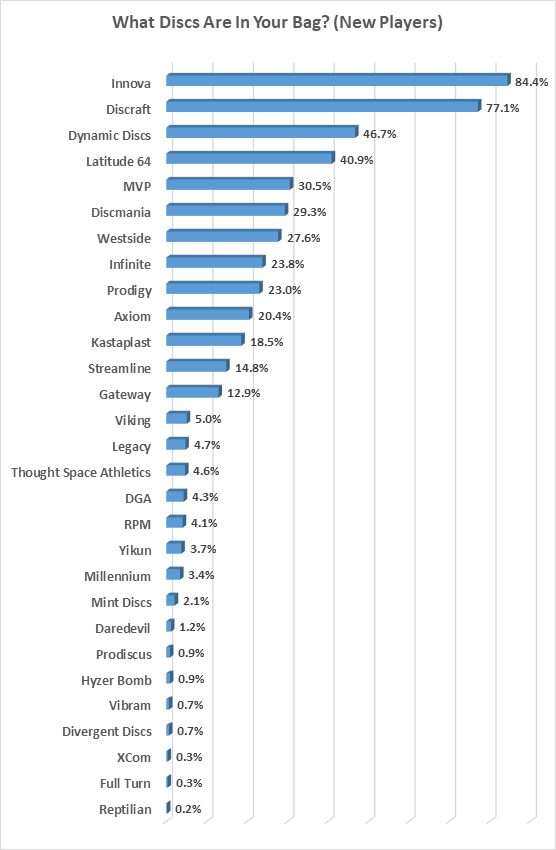

Alright, let’s take a look at what the new disc golfers are throwing. Because of the disc shortages experienced last year, I expected the discs in the bags of the new golfers to look like Infinite’s inventory: full of whatever disc golf brands we could get our hands on. It turns out that the typical new-person bag looks very similar to what everyone else’s bag looks like, statistically speaking. Here is the graph of the average bag, followed by the graph for the discs in the average new player’s bag.

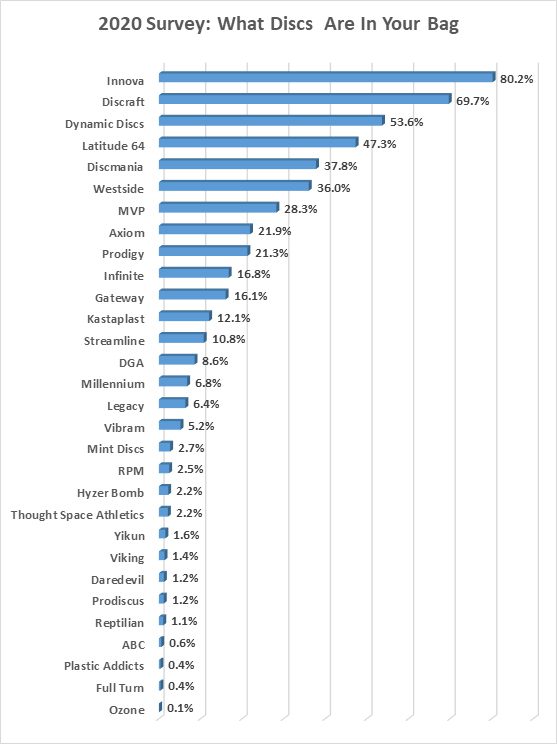

For comparison, below is a chart from last year’s survey showing what discs were in our bags. As you can see, the numbers are similar to the ones in the graphs above. That is both the percentage and the overall ranking of the top brands.

Although there are some differences with the new player’s numbers, most of them are pretty close to the group numbers. Many of the statistics are driven by available supply. However, taking a look at last year’s chart for the same category, we can see that they numbers aren’t too far away from what we’ve seen in the past. It will be interesting to see what changes take place in the future, based on what people had in their bags last year. How many people ended up trying new disc brands because that was all that was available? And will they stick with brands they were forced to try?

Give The Gift Of Disc Golf

I was curious to see where new players got their discs, and how many got them from their friends who invited them to play. That would help explain why the charts look similar. According to the survey, 45% of players who started playing last year received, among other sources, a disc as a gift. We didn’t differentiate in the survey between discs that were given by another player versus discs that were received as a present for Christmas, birthdays, etc. Getting a disc from another player might mean they are receiving brands that the friend throws.

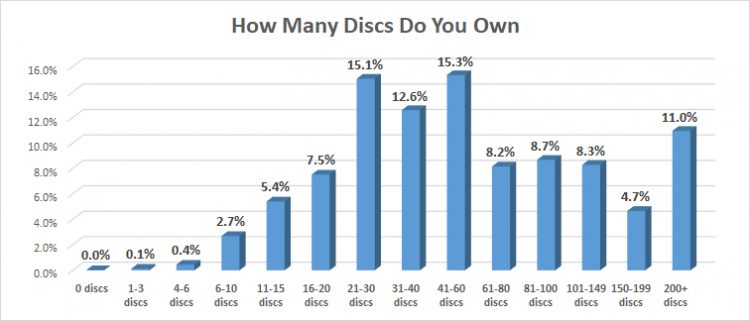

One other survey question I want to explore will tell us a little bit about how hooked the new players are on disc golf. We asked how many discs people own. Here is a graph of everybody’s answers:

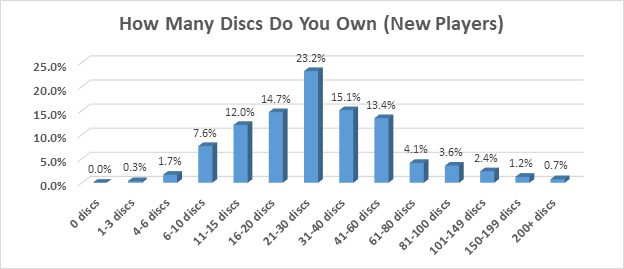

And here is a graph of the players who started playing last year. Although the new players have the lead compared to seasoned golfers up to the 31-40 discs category, after that the long timers take over as the leader. That makes sense because we have a tendency to increase our disc golf collection over time, whether we are keeping discs we don’t throw, have more wall hangers, or start to collect discs. Here is the graph:

In The Future

It will be interesting to see how the influx of new players affects the sport in the long run. Growth is good and hopefully will compound in the near future. We REALLY hope the supply/demand dynamic will flatten out soon so we can escape the hoarder mentality and be able to buy what we want when we want it.

Check back next week for more of the 2021 State of Disc Golf.

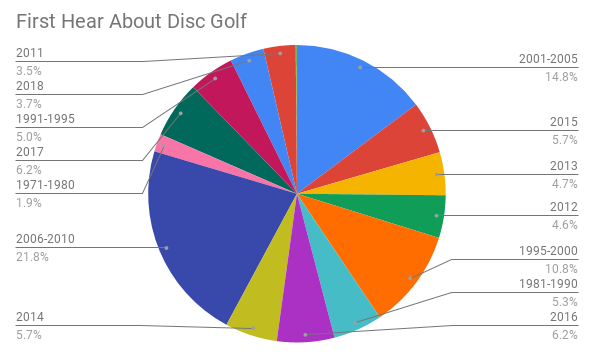

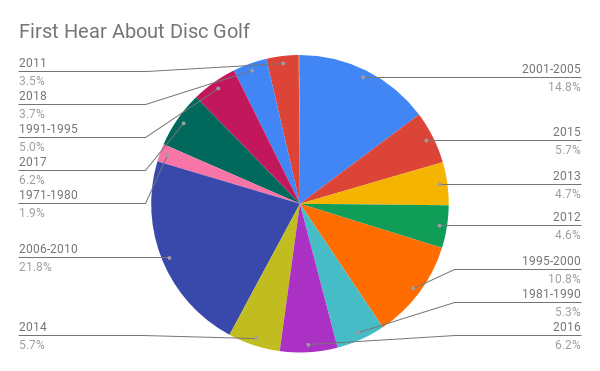

Infinite received more than 11,000 replies to the survey question ‘When did you begin playing golf?’ Nearly 75 percent named a year between 2006 and 2018, and less than 20 percent selected 2000 or earlier.

Infinite received more than 11,000 replies to the survey question ‘When did you begin playing golf?’ Nearly 75 percent named a year between 2006 and 2018, and less than 20 percent selected 2000 or earlier.