Trying To Find The Discs You Want in 2021

My time playing disc golf has been defined by things that have changed. Course basket locations change, my form as a player has gone through many changes, and even the discs themselves have physically changed when I slam them into trees off the tee-box.

Although some of the changes we have seen during 2020 have been awful, there have been many positives for disc golf. PDGA memberships, discs sold, and interest in the sport are at an all-time high. The PDGA reports that memberships are up above 15% from the previous year and tour events are up over 15% worldwide (with a 12.91% increase in the USA, and at least a 20% growth in Europe, Canada, Africa/Asia, and Latin America). And I’ve been told that not everyone in that 15% growth is a former Ultimate Frisbee player, despite what you may be hearing out there.

Unfortunately, some of the changes haven’t been great for disc golfers. Higher interest in the sport means courses are seeing more traffic, tournaments are seeing larger waitlists, and it has become tougher to find new discs due to production and stock issues.

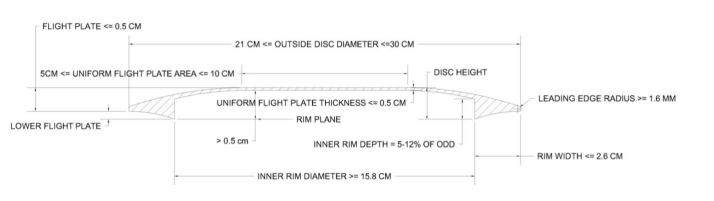

On the topic of finding new discs, it feels like this could be an easier problem to solve. The PDGA has strict technical standards for all disc manufacturers, so there are only a finite number of possible combinations in making discs.

If there are only a limited number of configurations allowed, then there must be discs that I would love out there that I haven’t tried to throw yet. It also means, there should be multiple options to replace my favorite lost, out of stock, or out of production disc.

In disc golf, sometimes great results happen due to skill, and sometimes they happen due to sheer luck. I need all the luck I can out on the course, so I will defer to the data in answering this question.

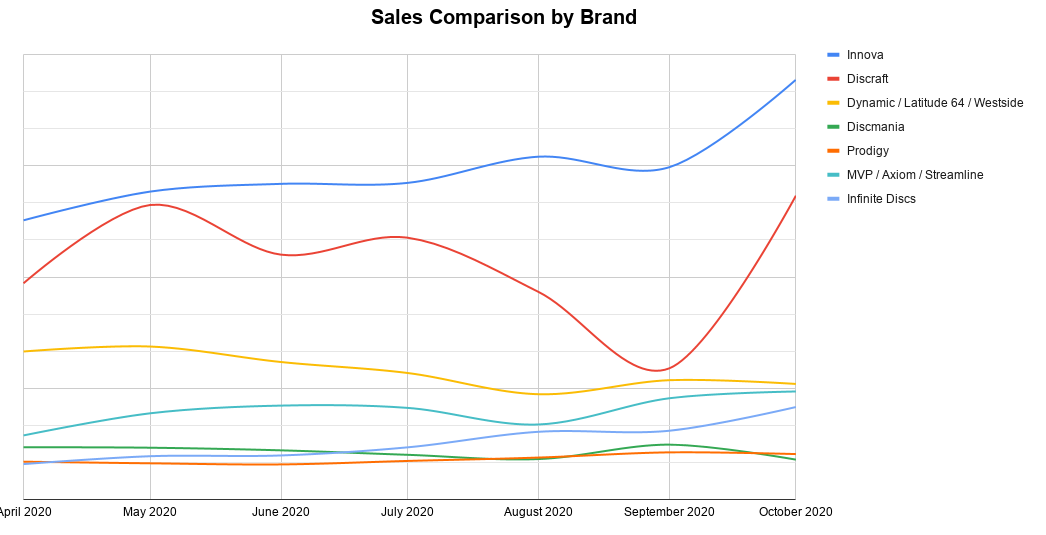

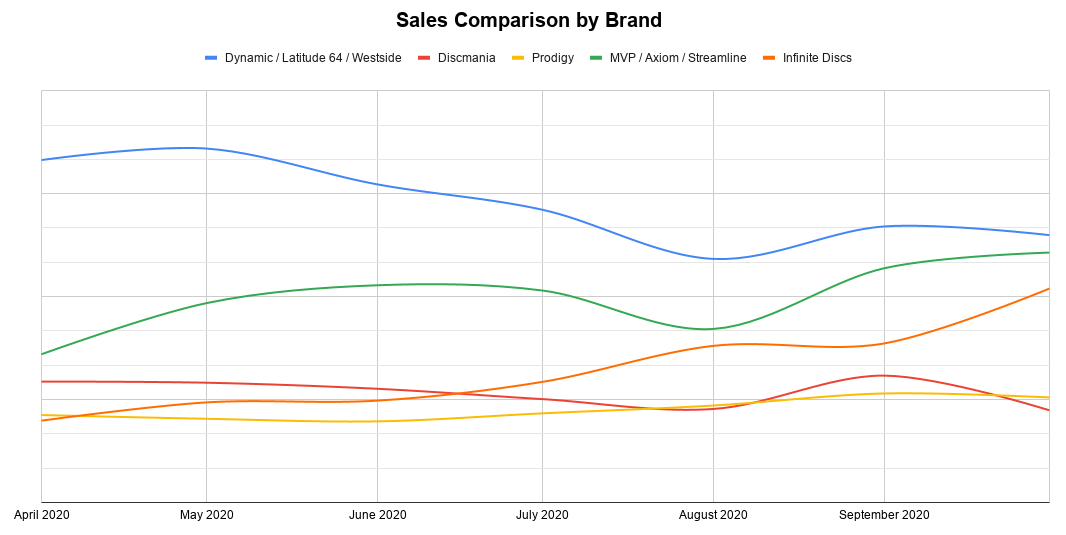

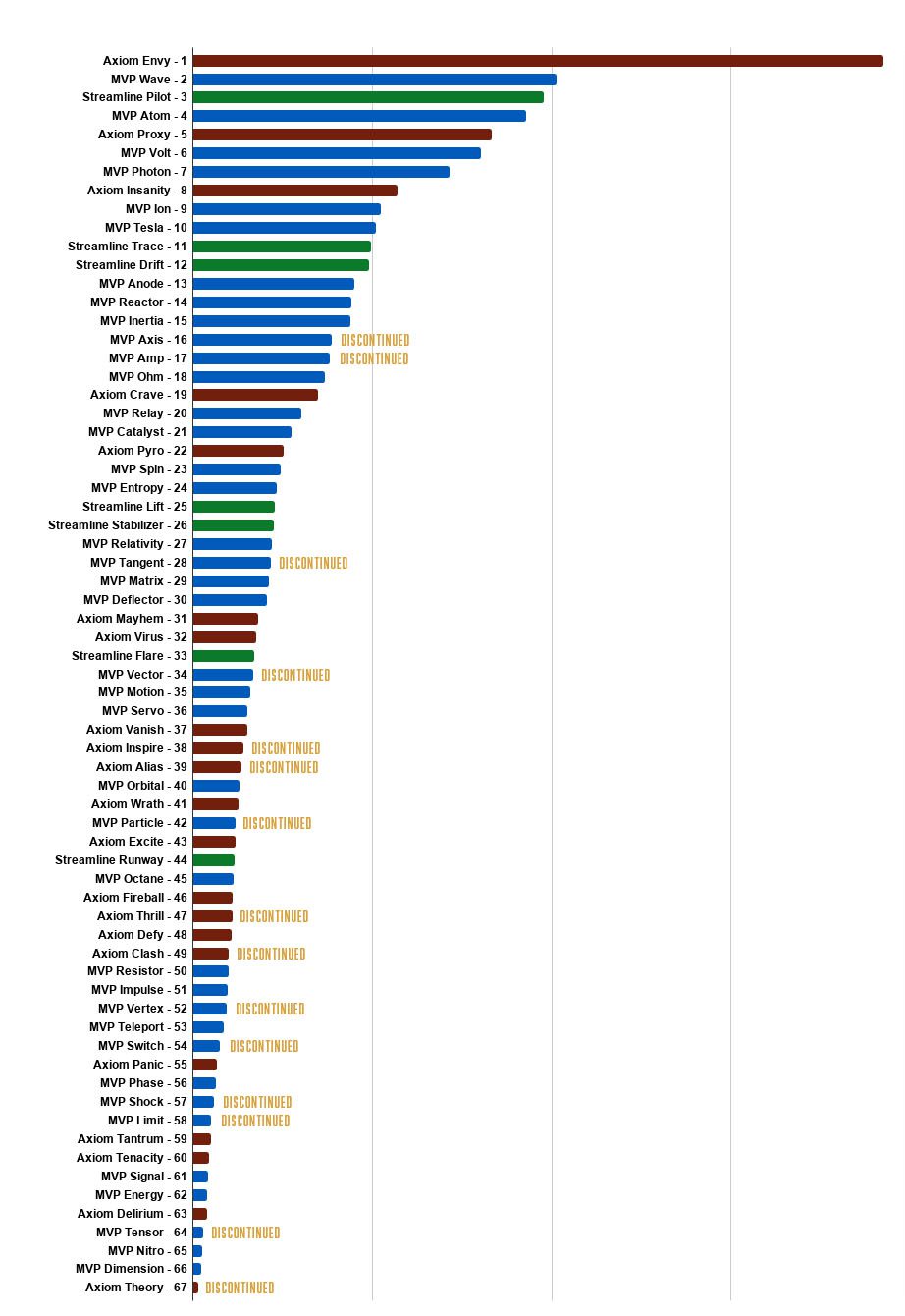

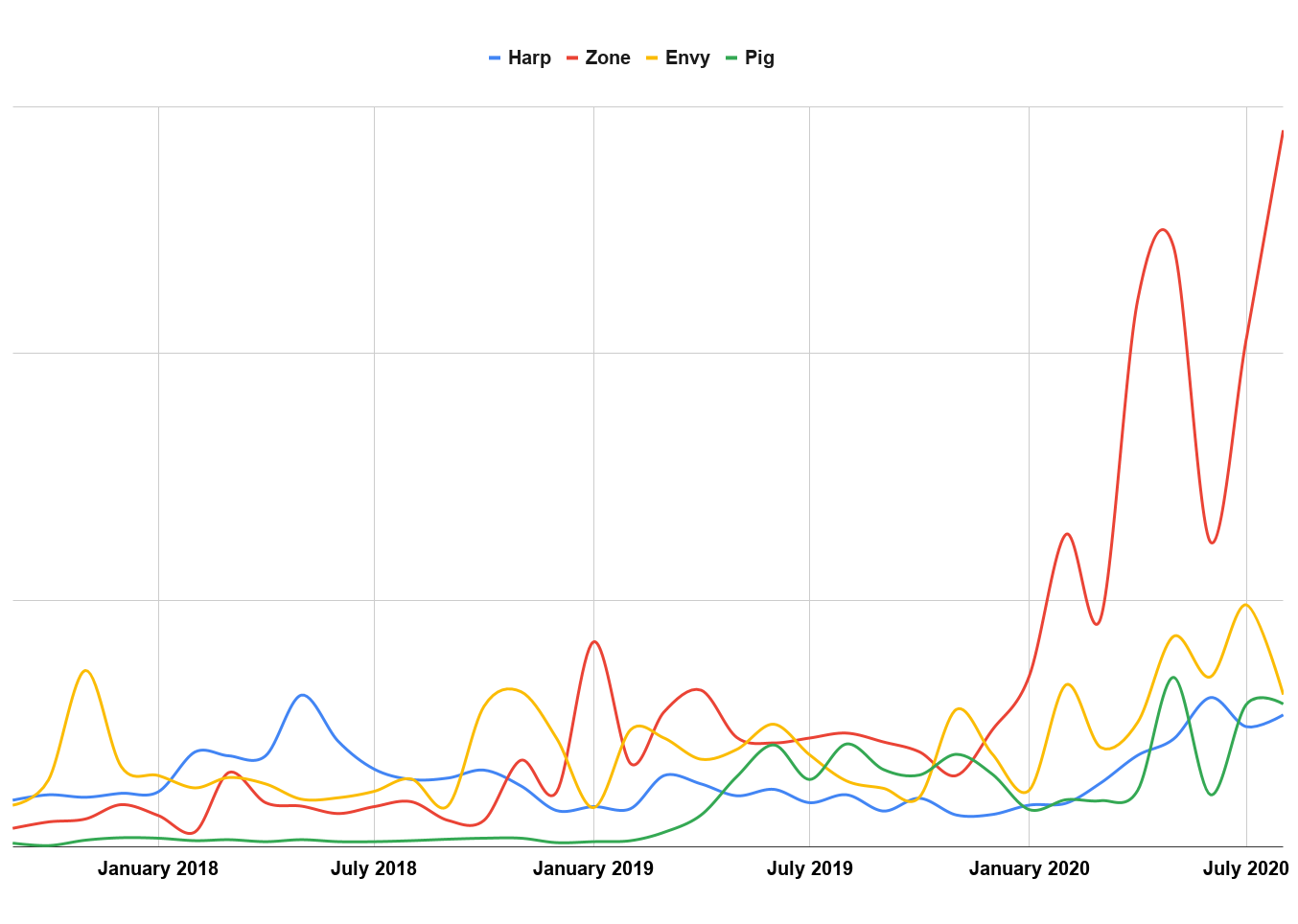

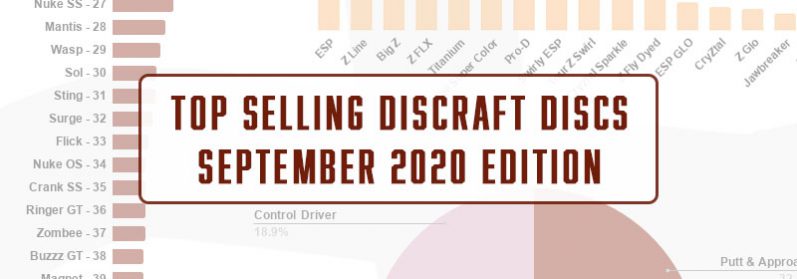

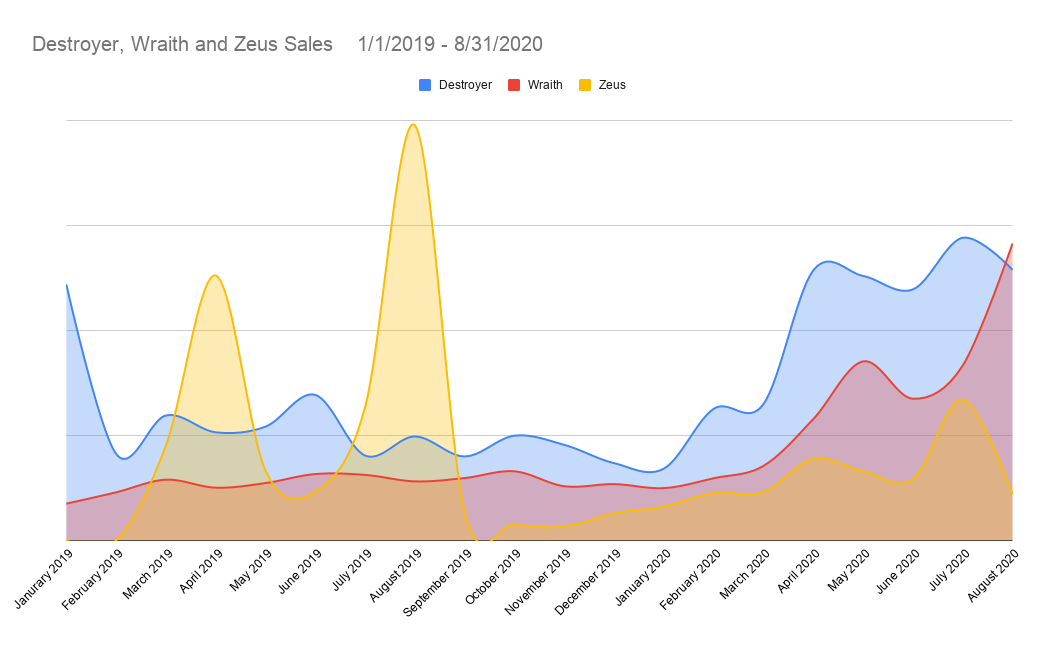

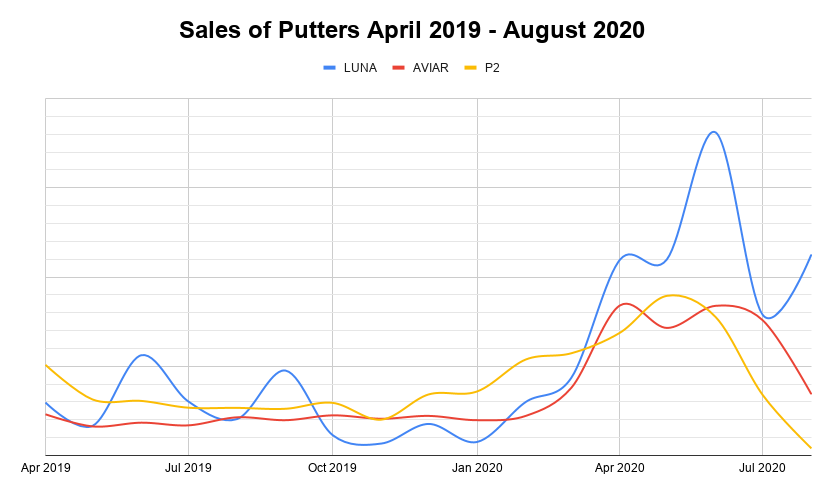

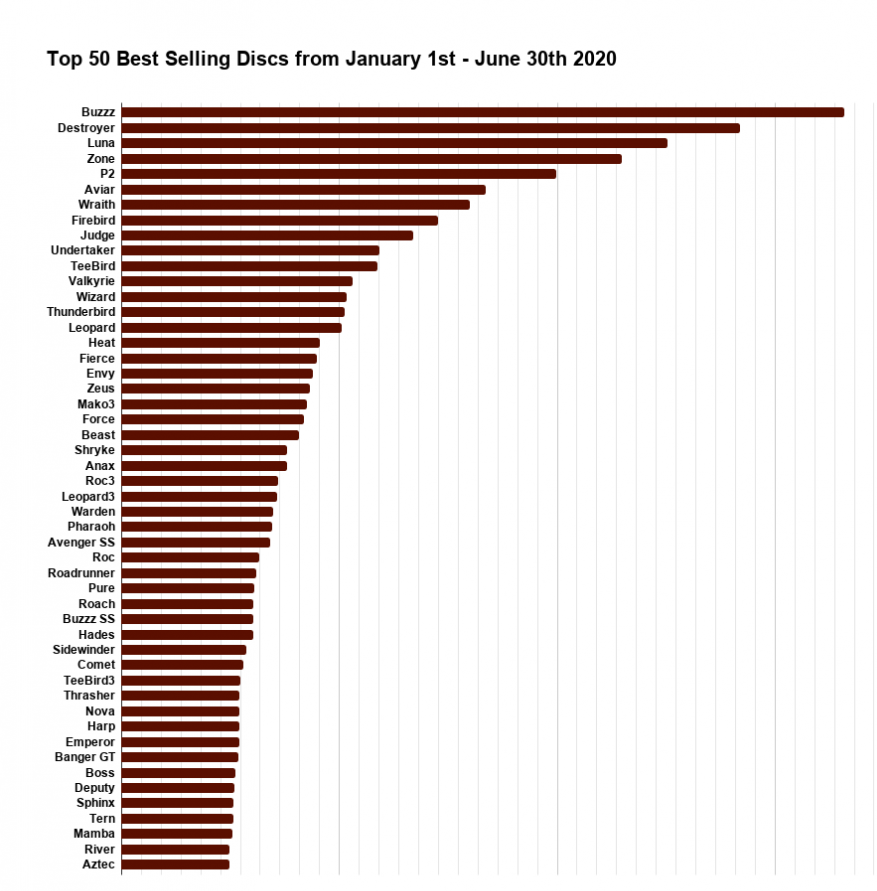

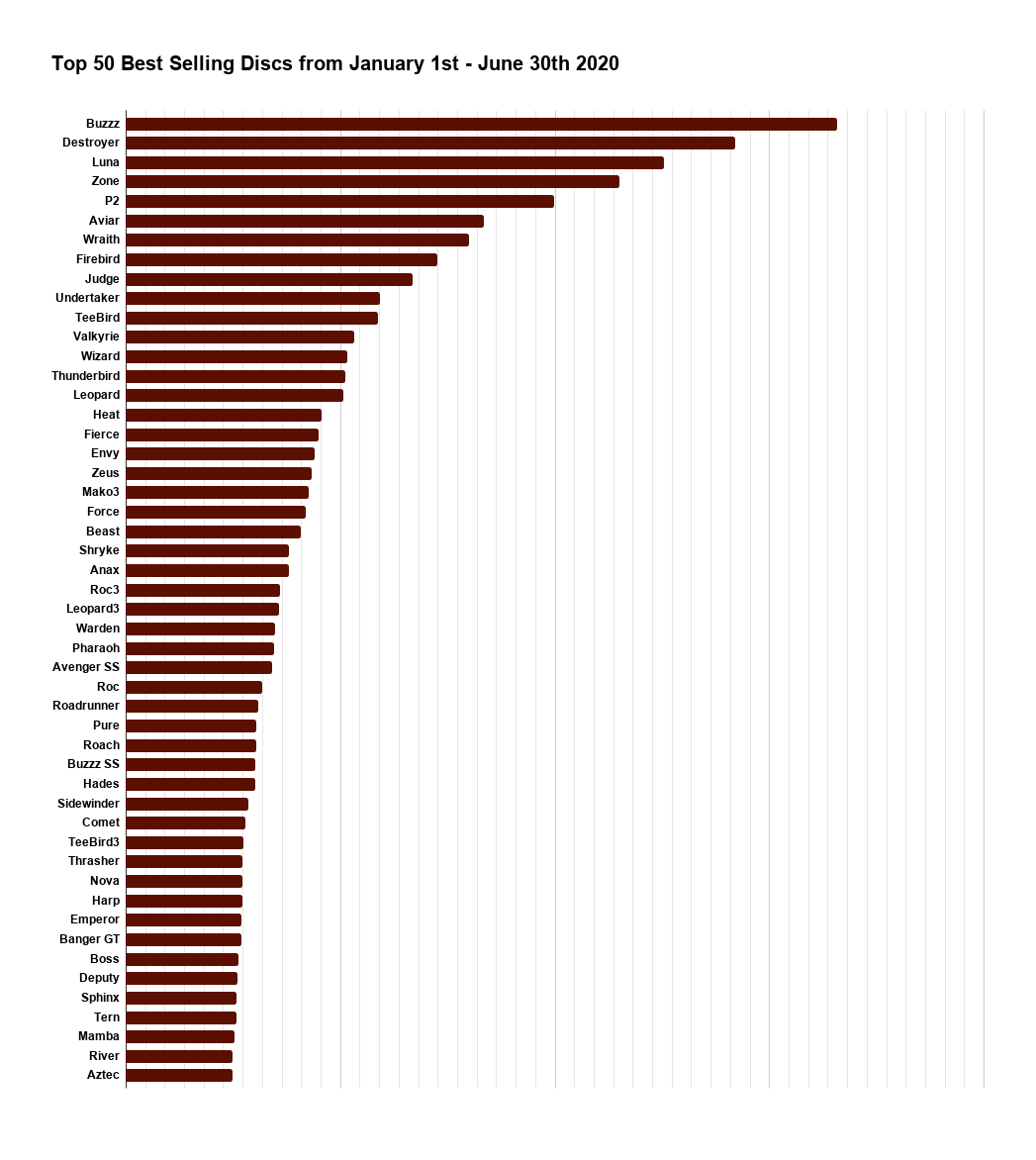

Using data from the Infinite Blog, I wanted to see what brands/discs were popular, and what other discs could be considered.

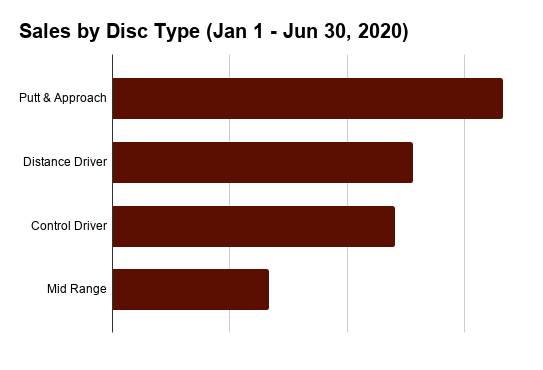

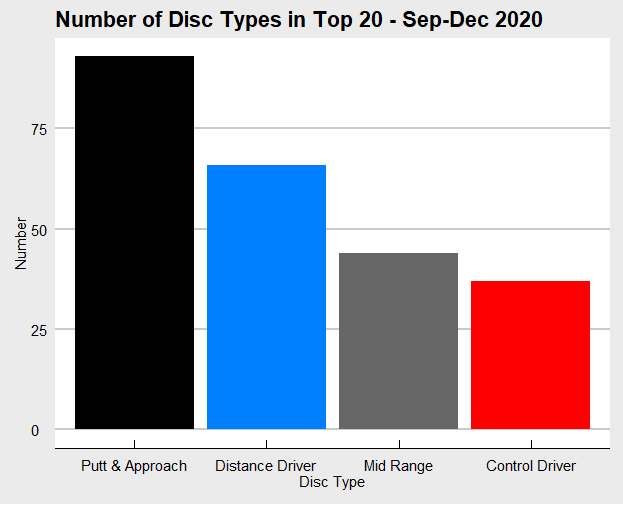

Let’s first look at what disc types make the Top 20 most often from the past 3 months.

Interesting to note that Control Drivers make the list the fewest number of times. Though I don’t have much arm speed or skill in general, I noticed that I also bag more distance drivers than control drivers.

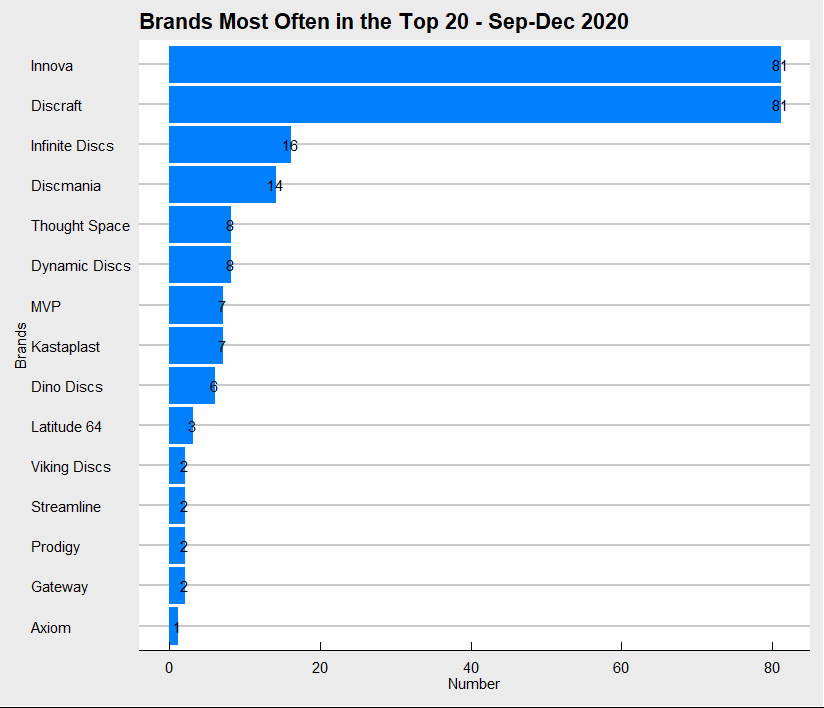

Now let’s see which brands show up the most in the Top 20 data.

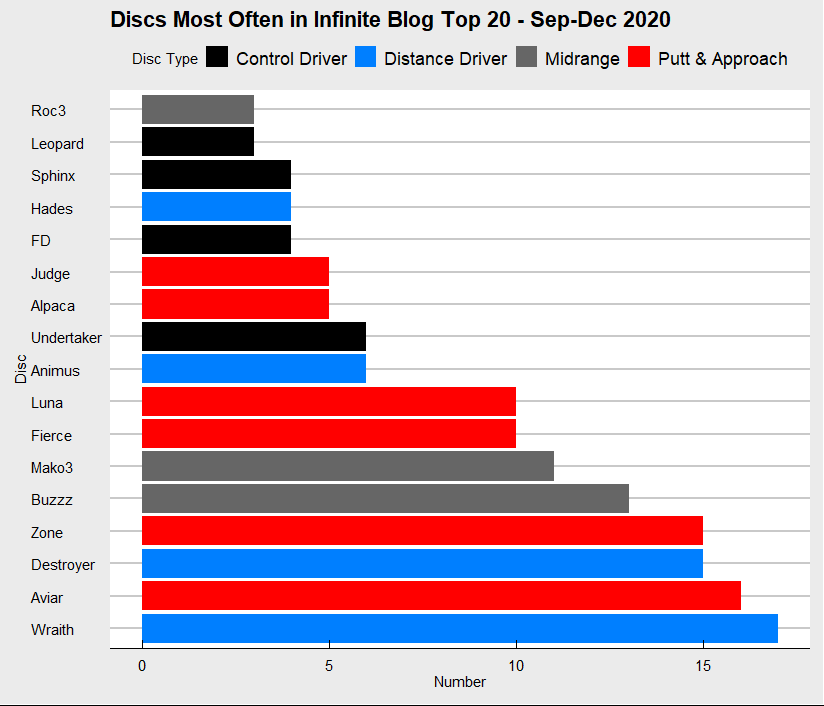

The big brands make up most sales, but we see some other great, smaller brands too. Now let’s see which individual discs appear most on the Top 20 data we are examining.

So, given today’s out of stock issues and the rise of some great new brands, I wanted to identify which discs are just as worth throwing as the most popular discs using disc dimensions provided by the PDGA, flight numbers provided by manufacturers, and all other data I could find.

It was eye opening to see how many similar options were out there from both big and small brands. The below table shows some of my findings.

| Disc | Similar Alternative 1 | Similar Alternative 2 | Similar Alternative 3 | |

| Distance Driver | Destroyer | Discraft Surge | Axiom Discs Defy | MVP Photon |

| Control Driver | Sphinx | Discraft Heat | Westside Discs Underworld | Legacy Mongoose |

| Control Driver | FD | Latitude 64 River | Gateway Assassin | Kastaplast Falk |

| Mid Range | Buzzz | Innova Colt | Axiom Theory | DGA Squall |

| Putt & Approach | Zone | Dynamic Discs Suspect | MVP Entropy | Infinite Discs Ruin |

| Putt & Approach | Aviar | Discmania Link | Yikun Discs Claws | Infinite Discs Alpaca |

If you’re interested in seeing alternatives for other discs, I’ve compiled this research into a web tool. This is a great tool to help you find discs golf discs similar to your favorites when they are sold out. Check it out here: www.TryDiscs.com

The quest to find my perfect disc is still ongoing. I may never get there but the journey of throwing and trying new discs is most of the fun.

This is a guest post submitted by Hasan Iqbal

Author Bio:

Hasan grew up in Georgia and has become obsessed with disc golf since he started playing in 2018. Hasan attended Georgia State University and the University of Delaware and is now working as a data scientist. In his spare time, Hasan has been working on Try Discs to help disc golfers find their next favorite disc. He can regularly be found on the wonderful courses around metro Atlanta with his dog, Scooby.